Why oil prices are so high

Posted Apr 03, 2024 by: Bulent Temel, Ph.D.

Oil prices have risen rapidly and erratically over the course of the last 25 years. Crude oil first purchase price, which was only 20% higher in 1999 than in 1974, is 900% higher today than in 1999. Historical trajectory of prices reveals that oil prices have not only risen sharply, but they also have risen frantically.

Source: US Energy Information Administration, https://www.eia.gov/dnav/pet/h....

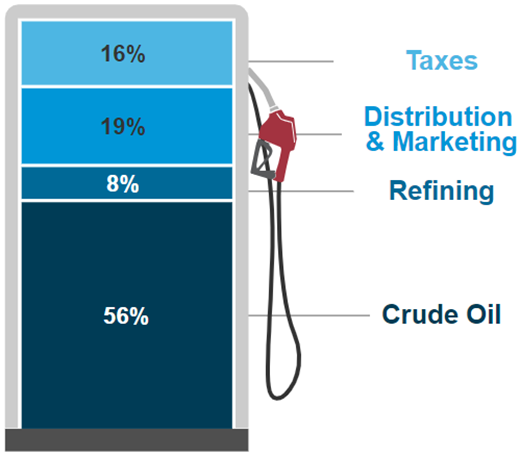

To get a sense of what is going on, we need to first consider how the price we pay at the pump is determined. Gas prices US consumers pay at the pump ($3.27-$4.06 on average for the three grades of gas today) are a function of four main factors:

International barrel price of crude oil (56% of the final price)

Distribution and marketing costs of suppliers (19% of the price)

(Pigouvian) Taxes on gas (16%)

- Refining costs (8%).

Source: US Energy Information Administration, https://www.eia.gov/petroleum/....

Because more than half of gas prices derive from global oil prices and they are much more volatile than the other three factors over time, international crude oil prices is the single largest determinant of high gas prices around the world. OPEC, the world’s largest oil producing actor, contributes to higher prices with a number of inefficiencies it creates for global markets. Firstly, it has been operating as an international cartel –that is, a non-compete gentlemen’s agreement between supposed competitors. Although 22 countries that constitute OPEC+ today (12 members and 10 non-member allies) are sovereign states, they determine their production levels and subsequently prices of their nationalized industries together –rather than independently as competitors do. As a result, OPEC+’s total production, which constitutes 40% of global supply, remains below the levels that would have occurred if the global oil market operated as a free market with many competitors. Below-efficient output from OPEC+ disallows the global supply of oil to satisfy the global demand for oil, which pushes crude oil prices up.

OPEC’s low spare capacity (production that can be supplied within 30 days and sustained for at least 9o days) increases the risk premium attached to oil, which further increases oil prices. When the rainy day supply that is kept against any unexpected disruptions to global output such as weather events and political conflicts is low, commodity traders (97% of whom are speculators who buy and sell oil future contracts for the sole purpose of turning profits, with no intention to secure a predictable price for their clients’ actual use of oil in the future) enter increasingly more buy orders for oil futures at higher prices. Because such a large percent of oil trading is handled out of this motivation (and only 3% for proper risk hedging), it creates a self-fulfilling prophecy and commodities markets attribute a higher value for the future of oil.

OPEC’s occasional political behaviors further this sentiment of increased risk premium for crude oil. OPEC was established in 1960 with the world’s second largest oil producer, Saudi Arabia making this offer to four smaller producer governments in its region: You join my club so we fix our output and prices instead of continuing our mutually-detrimental competition and I will provide you the political muscle you need as the producer of the world’s most needed commodity in return. Over time, as the five-member club has grown to have 12 members (plus 10 others in OPEC+), OPEC leadership routinely exploits its significance for the global economy and uses it to accommodate its political agendas. 1973-74 Oil Crisis within the context of the Yom Kippur War has become an unforgettable example of it and demonstrated that oil is not just an economic commodity that earns money for its suppliers –it is a political economic commodity that also provides significant political power to whoever produces it. When the US Congress swiftly approved Nixon Administration’s request for $2.2 billion to support Israel against a few of OPEC members in the war, OPEC leadership retaliated by applying an embargo to the US and its allies. OPEC’s 25% supply cut within three months resulted in large scale gas shortages in the US, which led to gas prices quadrupling and an unusual economic condition called stagflation (simultaneous increases in inflation and unemployment) impacting the US economy. OPEC has flexed its political muscle several other times in later years including a drastic supply cut in 1999 which began the period of volatile rise in oil prices shown in the first graph above.

While these roles played by OPEC have been significant, it would be a mistake to attribute all of the problem to OPEC. For two reasons:

1. Over time, what economic theory predicts would happen to cartels has happened to OPEC, and today’s OPEC is more a loosely connected group of actors that routinely break the cartel agreement for their self-benefit than a proper cartel with binding quotas that are strictly observed for the common goal. Game theorists explain this mutation with the concept of prisoners’ dilemma. They predict that cartels would be doomed to a breakdown sooner or later, because sustaining a cartel requires cartel participants to trust each other, but economic actors that are unscrupulous enough to form a cartel would lack such trust towards one another. Accordingly, they start violating the cartel’s agreement, which eventually leads to the dismantling of the cartel as an anti-competition agreement. Both the number of OPEC member states that exceed their OPEC quotas and the frequency by which they do it have been rising, and it is among the reasons why OPEC leadership went on to bring together 10 other countries as non-member allies under the name of OPEC+ in 2016. Five OPEC counties have suspended their membership in OPEC to date –though one of them, Gabon rejoined in 2016.

2. Second reason why OPEC is not the only factor behind high and volatile oil prices we have experienced over the last 25 years is that OPEC was a similar factor in the years that preceded 1999 during which oil prices were stably low as well. Therefore, we must consider other major influences on oil markets since 1999 to understand the oil markets today. Of these factors, two stand out: Invention of internet technology and economic globalization. Since the 1990s, internet dramatically expanded business opportunities around the world from the most remote corners to the most densely populated urban centers, and measurably improved life standards for hundreds of millions of consumers. Similarly, the spread of globalization (especially in transportation field) and market capitalism around the world have further been associated with an expansion of consumption capabilities globally. Today, of the two largest economies in the world, US economy is 2.6 times and Chinese economy is a whopping 16 times its size in 1999. This means that tens of millions of people have broken out of poverty and entered the middle-class in their societies, and their consumption including oil consumption has risen dramatically alongside that welcome progress. Oil consumption has risen due to increased production in growing economies as well since most industrial production and home consumption rely on oil as the most efficient source of energy that provides highest number of calories per unit. Petroleum products made from crude oil and other hydrocarbon liquids constitute nearly a third of the global energy consumption today. As total supply of oil lags behind the increasing demand for it, oil prices go upward.

A second prong of the link between oil demand and prices is the environmental externalities oil consumption creates. As global uses of fossil fuels rise, it accelerates global warming, which according to independent research, is a partly naturally-occurring and partly man-made problem. It manifests itself as extreme and increasingly frequent weather events, and they increase the likelihood of supply disruptions in the future, which, combined with low spare capacities, increases the risk profile of oil as an economic commodity.

A third prong that explains why high global demand paves the way to higher oil prices is consumers’ dependence on oil. Unlike most other goods and services, oil has demand and supply that do not respond to market prices much. Consumers who heavily depend on oil for their transportation, home heating and businesses buy it no matter how high oil prices get (or they reduce their consumption less than how much oil prices rise, both in percentage terms). Supply of oil cannot be altered much according to the market price of oil either since oil is a fossil fuel that is a geological phenomenon, not a product manufactured in a factory from scratch. This condition, called price inelastic demand and supply in microeconomics, provide ample room for oil suppliers to increase their prices without any substantial fear of losing their market share and profitability.

Source: EIA, Refinitiv An LSEG Business and Oxford Economics.

Lastly, political instability around the world further contributes to the problem of high and volatile oil prices. ACLED (Armed Conflict Location & Event Data Project) analyses reveal that armed conflicts are occurring more frequently and casualty count has been rising around the world, and the Middle-East and Eastern Europe where nearly half of global oil is extracted is no exception. This threatens an even larger portion of global output due to the network effect. OPEC countries that are not in the region (such as Venezuela, Equator, Nigeria or Congo) would find incentives to raise their own barrel prices when an armed conflict disrupts the supply and pushes the prices offered by a conflict-ridden member of OPEC. Accordingly, about half of global supply of oil (with OPEC+ that includes Russia as well) has been vulnerable to political shocks. As the global risk premium for oil has risen since 1999, the volatility of oil prices has become more pronounced.

What can you do vis-à-vis expensive oil? Very little to change oil and gas prices, but there’s a lot you can do to change how much you pay on your home heating fuel. Joining a Fuel Membership Discount Program can save you up to a dollar per gallon over the year. Follow our blog for other ways to save money on heating your home and other household savings ideas and programs.